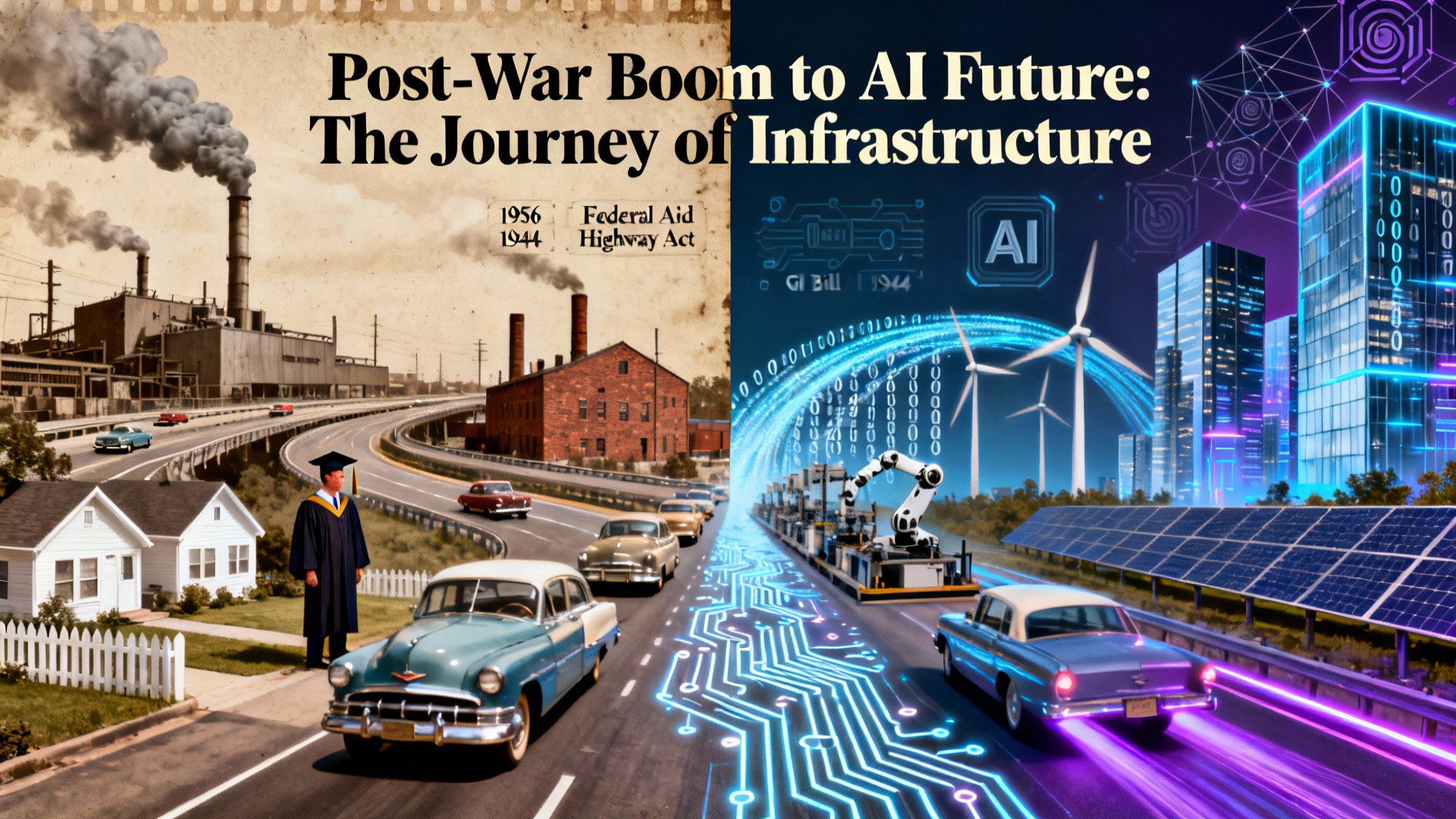

Imagine a time when the United States economy didn't just recover from war but surged to heights never seen before — real GDP multiplying nearly fivefold, families doubling their incomes, and highways knitting the nation closer. I remember reading about a trucking company owner in the 1950s marveling at how a trip that once took two weeks was suddenly a four-day journey thanks to a new highway. That story stuck with me because it shows how focused investment can transform an entire country. Today, as we face a $36 trillion debt mountain, those same strategies might hold the key to our future, particularly as artificial intelligence enters the scene. Let’s unpack how this economic miracle happened and what it means for us now.

The Post-War Economic Explosion: 1946–1970

When you look back at the years between 1946 and 1970, you’re not just seeing a recovery from World War II—you’re witnessing the most powerful surge in US economic growth the world had ever seen. The numbers are staggering. In 1945, America’s real GDP—meaning the value of all goods and services produced, adjusted for inflation—stood at $223 billion. By 1970, that figure had soared to $1.7 trillion. That’s a 380% increase in just 25 years. This wasn’t just about bigger numbers on paper; it was a transformation that touched every corner of American life.

From War Debt to Wealth: The Power of Real Economic Growth

After World War II, the US faced an enormous national debt. But here’s the lesson: when your economy grows faster than your debt, the burden shrinks in relative terms. The post-war economic expansion made the massive war debt seem almost trivial. As one economist put it,

“Debt becomes irrelevant when productivity explodes.”

And explode it did. The key wasn’t just inflation or clever accounting—it was real, sustained productivity growth. Between 1946 and 1970, productivity in the US grew by an average of 4.2% each year. That means every worker, every factory, and every farm was producing more each year than the last. This productivity boom was the engine that drove the US economic miracle.

How Productivity Growth Outpaced Debt

Let’s break down why this mattered so much for the country’s finances. During this period:

- Productivity growth: Averaged 4.2% annually (1946–1970)

- Inflation: Averaged 2.9% per year

- Interest rates on government bonds: Averaged just 2.1%

Because the economy was expanding faster than the cost of servicing the debt, the government could pay down what it owed without cutting spending or raising taxes dramatically. In fact, the debt-to-GDP ratio—the key measure of how much debt a country has compared to its economic output—dropped sharply. The debt became a manageable “background noise” rather than a looming crisis.

The American Dream: Doubling Incomes and Suburban Growth

This wasn’t just a story of numbers. It was a story of lives transformed. The average American family saw its income double during these 25 years. With more money in their pockets, families moved out of crowded cities and into new suburban neighborhoods. The iconic image of suburban America—tree-lined streets, single-family homes, and backyard barbecues—was born in this era.

Infrastructure played a huge role, too. The Federal Highway Administration oversaw the construction of the Interstate Highway System, connecting cities and fueling commerce. New schools, hospitals, and shopping centers sprang up across the country. The landscape of America changed before your eyes.

Why Did This Boom Happen?

Several forces came together to create this post-war economic expansion:

- Policy: The government invested in education, infrastructure, and scientific research, creating what some called a “productivity machine.”

- Demographics: The Baby Boom added millions of new workers and consumers, driving demand and expanding the labor force.

- Innovation: Advances in manufacturing, transportation, and technology made American businesses more efficient and competitive.

Importantly, economic policies were designed to support growth that outpaced debt servicing costs. This approach kept inflation and interest rates in check, while allowing productivity to flourish.

Lessons for Today: Growth Versus Debt

The post-war years show that real economic growth—not just inflation or financial tricks—is the most powerful tool for beating debt. When productivity rises and the economy expands, even the biggest debts can shrink to insignificance. The US experience from 1946 to 1970 is proof that with the right mix of policy, innovation, and demographic trends, a nation can turn a mountain of debt into a distant memory.

Building the Highway to Prosperity: The Federal Aid Highway Act of 1956

Imagine yourself as a trucking company owner in 1955. Back then, shipping goods from New York to Los Angeles was a logistical nightmare. The journey took two full weeks, with your trucks crawling through hundreds of small towns, each with its own traffic lights, speed limits, and bottlenecks. Every stop meant wasted fuel, extra hotel stays for drivers, and a higher risk of cargo damage. Serving customers across the country felt almost impossible, and your business growth was limited by the country’s patchwork of roads.

Then, in 1956, everything changed. President Eisenhower signed the Federal Aid Highway Act, authorizing a massive $25 billion investment—equivalent to $275 billion today—to build 41,000 miles of interstate highways. This wasn’t just a road-building project; it was a bold bet on infrastructure investment as a driver of national prosperity. The impact was immediate and profound, transforming not just how goods moved, but how Americans lived, worked, and shopped.

Revolutionizing Trucking and Logistics

With the new interstate system, your coast-to-coast shipping time dropped from 14 days to just four. Suddenly, your trucks could travel on a seamless ribbon of concrete, bypassing the slowdowns of small towns and city traffic. Fuel and labor costs plummeted, and your delivery reliability soared. According to the Federal Highway Administration, trucking productivity increased by 400% in the first decade after the interstate system was built. That’s not just a statistic—it’s a complete transformation of how business operated in America.

“The highway system was the arterial network pumping economic blood to every corner of the country.”

Economic Expansion Factors: The Multiplier Effect

But the real magic of the Federal Aid Highway Act was in its ripple effects—what economists call multiplier effects. These highways didn’t just move trucks faster; they enabled entirely new patterns of economic activity. Suddenly, it was possible to reach customers and markets that had been out of reach. Manufacturers could ship products nationwide with unprecedented speed and reliability, opening up new business opportunities and fueling real GDP growth.

Between 1956 and 1966, real GDP grew by 37%—a testament to how improved infrastructure can supercharge an economy. The highways acted as arterial economic networks, connecting cities, towns, and rural areas, and pumping growth into every region of the country.

Suburban Retail Boom: Shopping Centers and Consumer Behavior

The impact of the interstate system wasn’t limited to transportation and logistics. It also changed where and how Americans lived and shopped. As highways made it easier to travel longer distances quickly, millions of families moved to the suburbs. Shopping centers and malls sprang up at highway exits, creating a new kind of retail experience. For the first time, you and your neighbors could reach a wide variety of stores within a 30-minute drive.

- Shopping centers became accessible to millions, fueling a suburban retail revolution.

- Highways shaped America’s suburbanization patterns, influencing where homes, schools, and jobs were located.

- Retailers and manufacturers benefited from faster, more reliable supply chains.

Infrastructure Investment: A Blueprint for Growth

The Federal Aid Highway Act stands as a powerful example of how infrastructure investment can drive economic expansion. By reducing shipping times and costs, the interstate system made American businesses more competitive and efficient. It also changed consumer behavior, making suburban living and shopping a central part of American life. The highways didn’t just connect places—they connected people to opportunity, fueling decades of prosperity.

As you look back, it’s clear that the decision to invest in transportation infrastructure wasn’t just about roads. It was about building the foundation for a modern, dynamic economy—one where growth could reach every corner of the country, thanks to the highways that tied it all together.

From Assembly Lines to Automation: The Manufacturing Revolution

Imagine standing on the floor of an American factory in the early 1950s. The air is thick with the hum of machines, but something is different. Instead of rows and rows of workers assembling parts by hand, you see sleek, automated lines moving with precision. This was the dawn of US manufacturing automation, a bold leap that would change not only how things were made, but also the very shape of the American economy.

Massive Bets on Automation: The Courage to Invest

After World War II, America was still carrying a heavy load of war debt. Yet, leaders in manufacturing didn’t just play it safe—they doubled down. Take General Motors, for example. Between 1947 and 1955, GM invested a staggering $3.5 billion into automated assembly lines. That’s a huge sum, especially when you consider the technology was still new and unproven. It took real courage to make such a bet, but it paid off in ways that would shape the future.

The Ford Cleveland Miracle: Productivity Reimagined

Now, picture Ford’s Cleveland engine plant in 1951. With just 200 workers, this plant was able to produce 3,000 engines every single day. To put that in perspective, just five years earlier, it would have taken 1,500 workers to reach the same output. That’s a 750% increase in productivity per worker.

“Just years before, your costs per unit collapse, your production capacity explodes.”

If you were a factory manager at that time, you’d be witnessing something almost magical. One worker with automated equipment could now do what seven workers did by hand. The impact? Your costs per unit drop dramatically, you can make more products than ever before, and you’re able to sell them at lower prices while still increasing your profits. This is the heart of manufacturing productivity growth.

Automation History in US Manufacturing: Data That Tells the Story

The numbers from this era are nothing short of remarkable. According to the Bureau of Labor Statistics, US manufacturing productivity grew at 3.1% annually between 1947 and 1965. Compare that to just 1.2% per year in the decades before the war. This wasn’t just a small bump—it was a revolution.

- $3.5 billion invested in automation by General Motors (1947–1955)

- 3,000 engines daily with 200 workers at Ford’s Cleveland plant (1951)

- 750% increase in productivity per worker

- 3.1% annual productivity growth in manufacturing (1947–1965)

America Becomes the Workshop of the World

By 1960, the United States was producing a jaw-dropping 60% of the world’s manufacturing output. That’s right—six out of every ten manufactured goods on the planet came from American factories. This wasn’t just about making more stuff; it was about reshaping global markets and setting the stage for decades of economic growth from 1946 to 1970.

Automation didn’t just make things faster or cheaper. It allowed American companies to lower prices, reach bigger markets, and still boost their profits. This new era also changed the workforce. There were fewer jobs on the factory floor, but the jobs that remained required more skill and paid better wages. The shift in labor dynamics was profound, as workers adapted to new roles alongside advanced machines.

How Automation Fueled Economic Expansion

The leap in automation history US manufacturing was a key driver of America’s post-war boom. As productivity soared, so did the nation’s economic output. The gains from automation helped the US grow its way out of debt, supporting everything from new highways to the rise of the middle class. The manufacturing sector’s embrace of automation set the foundation for America’s industrial dominance and showed the world what was possible when you invest in innovation—even when the future is uncertain.

Education and Innovation: The GI Bill’s Longest Dividend

When you think about the post-war economic expansion in America, it’s easy to picture factories humming and highways stretching across the country. But the real engine behind this boom wasn’t just steel and concrete—it was education. The GI Bill, officially known as the Servicemen’s Readjustment Act of 1944, stands as one of the most powerful investments in US history. Its effects on education productivity impact, US economic growth, and innovation are still felt today.

The $14.5 Billion Bet on Human Capital

After World War II, America faced a huge challenge: how to help millions of veterans transition back to civilian life. The answer was bold—invest $14.5 billion in educating 7.8 million returning servicemen. This wasn’t just about giving them a leg up; it was about reshaping the entire workforce. By 1952, veterans made up nearly half—49%—of all college admissions. Imagine walking into a classroom and seeing that almost every other student was a veteran, ready to learn engineering, business, or science at the government’s expense.

Transforming the Workforce: From Soldiers to Skilled Professionals

The GI Bill effects went far beyond individual opportunity. It created a ripple effect that changed the face of American industry. Suddenly, the civilian workforce was infused with trained engineers, scientists, and business professionals. These were people who had seen the world, faced adversity, and now brought discipline and fresh perspectives to their studies and future jobs.

This new wave of skilled workers was critical for the era’s rapid automation and innovation. As one observer put it:

“You weren’t just educating soldiers, you were minting the minds that would design the automated factories.”

IBM and the Corporate Boom: A Case Study in GI Bill Effects

One of the clearest examples of the GI Bill’s impact on US economic growth is the story of IBM. In 1945, IBM had just 12,656 employees. By 1964, that number had soared to 104,241. The majority of IBM’s technical workforce during this period were GI Bill graduates. These were the men who filled the labs, designed new machines, and helped build the modern American corporation. The education productivity impact was direct—companies like IBM could grow, innovate, and lead the world because they had access to a skilled, educated workforce.

The Multiplier Effect: $1 In, $7 Out

Investing in education isn’t just good for individuals—it’s a win for the entire economy. According to the Congressional Budget Office, every dollar spent on GI Bill education returned $7 to the economy through higher productivity and increased tax revenues. That’s an incredible return on investment. It shows that when you equip people with knowledge and skills, you multiply human capability and set the stage for long-term economic growth.

- $14.5 billion invested in education for veterans

- 7.8 million veterans educated

- 49% of college admissions were veterans by 1952

- IBM grew from 12,656 to 104,241 employees (1945–1964), fueled by GI Bill graduates

- $7 economic return for every $1 spent on education

Laying the Groundwork for Modern America

The GI Bill didn’t just help veterans—it helped America leap forward. By multiplying the nation’s human capital, it laid the groundwork for decades of innovation, productivity, and prosperity. The education and training provided under the GI Bill created a generation ready to lead in science, engineering, and business. This was the foundation for the technological leadership that defined post-war America and continues to influence the road ahead, especially as we face new challenges and opportunities with AI and automation.

The Undoing: How Post-1971 Policies Shattered the Productivity Machine

Let’s rewind to a quiet Sunday night in August 1971. President Richard Nixon, sitting at his Oval Office desk, made a calm but world-changing announcement: the United States would “suspend temporarily the convertibility of the dollar into gold.” That word—temporarily—turned out to be permanent. In that moment, the Bretton Woods system, which had kept global currencies anchored to the US dollar and gold since 1944, ended. Most Americans didn’t realize it, but this was the start of a new era—one that would fundamentally change US economic policy, the Debt to GDP ratio, and the way we handle national debt crises.

The Gold Standard: The Original Brake Pedal

Before 1971, America’s borrowing had a hard limit. The gold standard acted as an external brake. If the US printed too many dollars or borrowed too much, foreign central banks could demand gold in exchange for those dollars at a fixed rate—$35 an ounce. This wasn’t just a technicality; it was a forcing function. Fiscal discipline wasn’t optional. If you wanted to spend, you had to invest in productivity and growth, not just print more money.

France, for example, called America’s bluff in the 1960s, draining US gold reserves to protest loose monetary policy. By August 1971, US gold reserves had dropped from 701 million ounces in 1949 to just 286 million. The world was watching, and the US had to fold.

Unleashing Debt: The Aftermath of Nixon’s Suspension

Once Nixon cut the dollar’s link to gold, the US was free from external discipline. Suddenly, there was no need to worry about foreign governments demanding gold. The government could borrow and print dollars without fear of a gold run. At first, this felt liberating—no more foreign interference in American economic policy. But something crucial disappeared: the pressure to maintain productivity growth.

With the gold standard gone, the US could simply borrow more to solve problems. The focus shifted from investing in the real economy to managing crises with debt. The numbers tell the story:

- Debt to GDP ratio averaged around 40% before 1971, held in check by the gold standard.

- After 1971, the ratio began a steady climb, reaching 123% by 2024.

- US government debt rose from $909 billion in 1980 to $1.37 trillion in 1982.

“We removed the brake pedal and wondered why the car kept accelerating.”

Federal Reserve Interest Rates History: Fighting Fires, Not Building Engines

With the loss of fiscal discipline, the Federal Reserve’s interest rates history became a series of reactions to crises. In the late 1970s, inflation soared. Fed Chair Paul Volcker responded with the famous “Volcker Shock,” raising rates to nearly 20% by 1981. This tamed inflation but triggered a deep recession—and, ironically, even more government borrowing.

Each time the economy hit trouble, the solution was more debt. After every recession, the new, higher level of debt became the baseline. Borrowing that was supposed to be temporary became permanent. Instead of investing in productivity to grow our way out of trouble, we cushioned the pain with more borrowing. This cycle repeated through the 1980s, 1990s, and into the 21st century.

From Growth to Crisis Management: The Shift in Economic Policy

The post-war economic boom was built on three pillars:

- Productivity investments

- Constrained borrowing

- Interest rates below growth rates

After 1971, these pillars crumbled. Economic policy shifted from building the future to treating the symptoms of each crisis. The loss of forced fiscal discipline meant that borrowing replaced targeted investment. The result? A US national debt crisis that grew with every downturn, and a Debt to GDP ratio that never returned to pre-1971 levels.

Today, we’re living with the consequences. The productivity machine that powered America’s post-war miracle was dismantled, replaced by a cycle of crisis borrowing and debt accumulation. The discipline that once forced us to invest in real growth is gone—and the debt keeps accelerating.

COVID-19, Debt Explosion, and the Productivity Stagnation

The impact of COVID-19 on the US economy was immediate and dramatic. In March 2020, the pandemic forced the world into what many called an “induced coma.” Businesses shuttered overnight, millions lost jobs, and the government stepped in with a rescue plan unlike anything seen before. The CARES Act, passed on March 27, 2020, authorized a staggering $2.2 trillion in relief spending. And that was just the beginning. Over the next year, Congress passed additional bills, bringing the total to over $5 trillion in emergency spending within just 24 months.

To put this in perspective, it took the United States from 1776 to 2005—nearly 230 years—to accumulate its first $8 trillion in national debt. During the pandemic, the US added $5.2 trillion in just two years. This was the fastest peacetime expansion of debt in American history. The debt-to-GDP ratio soared to 123%, raising serious questions about long-term sustainability.

The Federal Reserve’s Money Printing Frenzy

It wasn’t just Congress opening the floodgates. The Federal Reserve took extraordinary measures to keep the economy afloat. In March 2020, the Fed’s balance sheet stood at $4.2 trillion. By April 2022, it had more than doubled to $8.9 trillion. The Fed was buying $120 billion in Treasuries and mortgage bonds every month. Internet memes joked that the “money printer went brrr,” but the reality was no laughing matter. This massive injection of liquidity was designed to stabilize markets and prevent a financial meltdown.

Debt Explodes While Productivity Stagnates

With all this spending, you might expect a boom in US economic growth or a surge in productivity. But the numbers tell a different story. From 2020 to 2022, GDP growth averaged just 1.9%. Productivity growth was even weaker, averaging only 1.3%. As one observer put it,

“Debt explodes while productivity stagnates.”

This divergence is both complete and undeniable. Unlike the post-war era, when government spending built highways, funded education, and laid the groundwork for decades of growth, the COVID-19 response was focused almost entirely on immediate relief. The money went to stimulus checks, expanded unemployment benefits, and business loans to keep people afloat. These measures were vital for preventing a deeper recession, but they did little to increase the nation’s productive capacity.

Government Spending Impact: Saving Consumption, Not Building for the Future

The government spending impact during the pandemic was clear: it saved consumption. People were able to pay rent, buy groceries, and keep the lights on. Businesses avoided mass bankruptcies. But this rescue came at a cost. The debt piled up rapidly, and the money did not go into infrastructure, research, or education—the kinds of investments that fuel long-term productivity and growth.

- CARES Act and subsequent bills: Over $5 trillion in relief spending within two years

- Federal Reserve balance sheet: Expanded from $4.2 trillion to $8.9 trillion

- US debt increase: $5.2 trillion in just 24 months

- GDP growth (2020–2022): Averaged 1.9%

- Productivity growth (2020–2022): Just 1.3%

Unlike the post-war boom, where debt financed the future, the COVID-19 response was about survival. The result? A record-breaking increase in debt without the productivity gains needed to pay it down. The impact of COVID-19 on America’s debt-to-GDP ratio and economic growth is a cautionary tale. As we look ahead, the challenge is clear: how can the US manage its debt sustainably when so much recent borrowing has not built the foundation for future prosperity?

The Future: Can AI Rebuild America’s Productivity Engine?

Let’s look at where we stand today. As of December 2024, the US federal debt has soared to $36.2 trillion—about 123% of our GDP. That number can feel overwhelming, but history tells us there’s a way out. After World War II, America faced a mountain of debt, too. The solution wasn’t just paying it down dollar by dollar; it was igniting a surge in productivity that made the debt seem small by comparison. As one economist put it,

“The post-war generation proved debt becomes irrelevant when productivity explodes.”

Back then, automation and education were the twin engines of growth. Factories rolled out more goods with fewer hands, and the GI Bill sent millions to college, multiplying human capability. The result? A booming economy that dwarfed the debt. But here’s the catch: it took 25 years to pull off that transformation. Today, with debt piling up faster than ever, we may not have the luxury of time.

This is where artificial intelligence steps in. Right now, US companies are racing to adopt AI tools, hoping for a fresh AI productivity boost that could rival—or even exceed—the gains of the post-war era. From automating routine office work to supercharging research and development, AI promises to help us do more with less. It’s a playbook that feels familiar: invest in breakthrough technology, empower people to use it, and watch economic growth take off.

Elon Musk and other tech leaders have made bold AI predictions, suggesting that AI could fundamentally transform the pace of US economic growth. Imagine a world where AI handles the mundane, freeing up humans for creative and strategic work. That’s the vision: an economy so dynamic that today’s debt burden fades into the background, just as it did after WWII.

But there’s a big question mark hanging over all this. Can AI deliver fast enough? The mathematics of debt don’t wait for anyone. While early studies and long-term economic forecasts are optimistic—showing AI could replicate or even outpace historical productivity growth rates—there’s still skepticism about how quickly these benefits will show up in GDP numbers. The post-war boom had decades to play out; our current economic pressures may demand results in far less time.

That’s why policy support is so crucial. Just as the government once built interstate highways and funded mass education, today’s leaders need to double down on investments in automation, digital infrastructure, and upskilling the workforce. The multiplier effects from AI could be huge, but only if we prepare people to use these new tools and make sure businesses of all sizes can access them. Without this support, there’s a real risk that productivity growth will stall, leaving us stuck with high debt and slow economic progress.

It’s also important to remember that not everyone is convinced AI will be a silver bullet. Some worry about job displacement, while others question whether AI’s impact on productivity will be as broad as past innovations. But the alternative—failing to rebuild our productivity engine—could mean a future of permanent debt stagnation and economic crisis.

In the end, the lesson from the post-war boom is clear: technology and education, working together, can transform the economy and make even the biggest debts manageable. Artificial intelligence might just be the modern key to reviving productivity growth, if we act quickly and wisely. The road ahead won’t be easy, but history shows that with the right investments and a focus on empowering people, America’s productivity engine can roar back to life—and with it, a new era of prosperity and stability.

TL;DR: Post-war America’s economic leap was no accident—it was engineered through massive investment in highways, manufacturing automation, and education via the GI Bill, boosting productivity faster than debt grew. Today’s debt crisis traces back to abandoning these principles, but AI offers a new chance to reignite growth—if we act fast.

0 Comments